Remember the formula and your goal

Saving enough money so that the passive income generated will cover all your expenses

We already talked about saving…what about passive income?

Passive Income

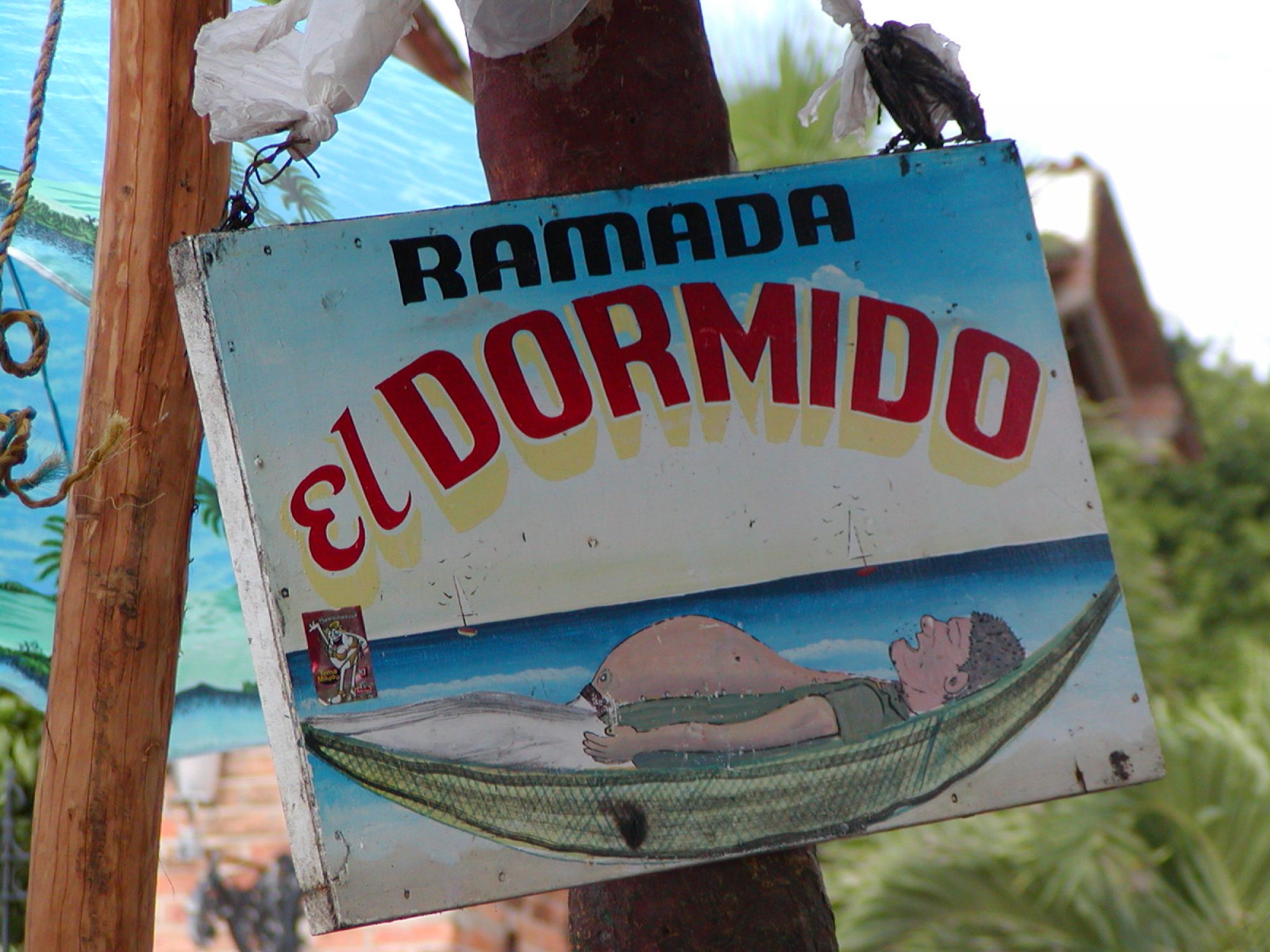

Passive income is the ultimate goal and dream….a vehicle that generates money 24/7 no matter what we do (sleep, golf, watching TV) thus the name passive.

Being paid to do what you like, no boss, no alarm in the morning, no customers…no bad right?

Now the question is how to build this vehicle, this mountain that will generate that lazy flow of money

Let’ s look again at our options…

Cash

While it’s good to have cash it can only lose value in time due to inflation.

Keep max 3 months of living expenses in cash and put it in some high yield checking or saving account that you can access instantly.

Period.

CD-Bonds

Safest passive investment and because of it with the lowest return, barely matching inflation. You can make a little more money with municipal bond or bond fund with a little extra risk.

Despite the low return bond should be an important portion of the invested portfolio; the closer you are to retirement the highest the portion you should keep in bonds since it’s better during retirement not to have all portfolio allocated in stocks because a recession can eat up a big portion of your stocks portfolio and you might not have the time to recoup it.

In the USA the Bond yield typically track the interest rate of the period and the longer the maturity the higher the yield (unless the economy is closer to a recession and the yield curve is flat or inverted)

Investing in a CD insures that you will get your capital back plus the promised yield at the maturity

Example

If on Jan 01 2010 I invest $10,000 in a 1 year CD offering an yield of 2% on Jan01 2011 I will get $10,200 (the initial $10,000 plus $200 (2% of $10,000))

Stocks Mutual Funds There are thousands Stocks Mutual Funds over there, most of them too complex to understand or designed in a fancy way to attract you and charge you expensive fees.

Forget about the products your banker is trying to sell you and go for low cost (<0.05%…even better 0 now from Fidelity) index fund that tracks the major index (like S&P 500 or FTSE).

Depending on where you live, check with your bank or financial services provider and go for it.

Again watch out the fund fee…you must select a fund with less than 0.05% fee per year (basically for $10000 invested you pay $5 year).

If you are an absolute beginner my suggestion is to invest 80% in a passive managed low cost index fund that track total market stock (USA or European) and the remaining 20% in an as well a passive managed low cost index fund that tracks the total market bond (USA or European).

If you have some form of pension tax deferred (like 401k in the USA) where your employer matches your salary contribution (1-5% typically) maximize this first, than maximize IRAs and only after invest in taxable accounts

Never ever underestimate tax and fee…they can wipe out your return or even worst making it negative.

Individual Stocks

The Las Vegas for stock pickers.

I have to admit, I sometimes picked some single stocks, allured by the name or the buzz around it.

Always remember,

You are not a stock expert and very likely (excluding Warren Buffet there are none around).

Why? Because you don’t have all the information about a company to be sure your investment is solid. One legal problem with the company you invested or government changes some rules and your stock can lose 20-30% in one day Have you ever imagined 20-30 years that company like Kodak or Nokia (add stock graph) could disappear? N(stock chart) I didn’t so who place all your money there lost everything.

To use a dramatization Think about on investing in a single stock like betting on one number in a roulette…big win if the stock soars but also high risk of lose everything.

Think about investing in the stock market through index fund on regularly betting some money on the red in a casino where red is slightly more frequent than black or zero

You will surely face temporally lose but on average and on long time you will make some money (chart stock s7p or dow)

Real Estate

It can be a good, bad or disastrous investment.

To minimize risks:

Rule#1: Location Location Location

Even thought it’s not certain, buying in downtown New York or San Francisco or in front a prestigious campus means buying a property with some intrinsic value.

Same for an oceanfront property or one close to a prestigious landmark (an apartment with a perennial obstructed view on the Eiffel tower).

I understand few people can afford this properties, foe the rest of us just do your due diligence, look for places with a healthy job market, universities, landscapes.

Look for unique features , be sure the competition around you is limited (e.g., no more buildings are allowed) .

Talk with trusted realtors, ask for data on comparable sales in the area and average rental (and average vacancies as well)

Study study study

One rule of the thumb says you should get 1% month of the property value per year in order to have positive cash flow (e.g. $2000 per month if your purchase price has been $200,000).

I find that nowadays getting 1% is very hard unless you were fortunate enough to get an excellent deal on the property or investing in some rural Midwest property during an economical expansion (but watch out at what might happen during an economical downturn to those properties).

In mature areas I find that 0.55-0.65% are more common rates during the first 5y of ownership with gradual increases.

Anyhow Real Estate when well purchased, financed and maintained can be a great investment in the long term and a good edge against the inflation since both the rentals and the values on average growth with the inflation.

Besides, based on where you have the property you can have great tax deductions increasing your ROI.

Peer to Peer Lending

A relatively new investment.

There are two kind of lending through an intermediary (usually a company with a website)

You basically act as a bank, landing money to privates (or small companies) for disparate investments from buying a car to invest in a multi-million dollars projects.

Of course the higher the risk the higher the return

Based on the country you reside you can also have detailed information about the borrower such as his credit history and based on this information the intermediary will fix the interest rate to charge him.

You can thus decide to lend money to high quality borrowers (who wants to keep that status to be able to access cheap credit) but a low interest rate or the opposite (to high risk borrowers thus charging higher interest rate)

Up to you…I personally prefer go for a mix to minimize my risks but at the same time getting some more return vs Treasury bond or other means of investment.

Still Confused? Don’t have to! Keep it simple

That’s all… and believe me it’s not so complicated like our banks or “financial advisors” want us to believe.

Don’t think investing is for Wall street gurus and complicated and the only way is to buy useless and very expensive managed mutual funds from the “financial advisors” with lower return vs the market.

Don’t overlook the importance to invest some money and time to maximize tax return, or to avoid to buy everything full price.

Believe that many people reach financial independence simply saving more money and investing wisely the difference.

Believe that there is an alternative life vs living paycheck by paycheck out there if you just want to chose it.

Just believe me