According to 2017 CareerBuilder study

Overall, 71 percent of all U.S. workers said they’re now in debt, up from 68 percent a year ago, CareerBuilder said.

While 46 percent said their debt is manageable, 56 percent said they were in over their heads. About 56 percent also save $100 or less each month, according to CareerBuilder.

On this subject people, especially in the USA, discussed and are discussing ad nauseam.

But still people seems not getting the importance of it, or simply don’t care.

And this is happening in the richest and most developed economy of the world.

Why?

Mindset and Ignorance .

Let’s analyze, change them and get the first step towards Financial Independence.

Let’s start with mindset.

Mindset

Western society are based on capitalism that in the last 60-70y (let’s say after the end of WW2) degenerated in the concept of need of constant growth and increase of consumption to sustain the economy.

The concept of the constant growth is a pillar of modern economy.

Economy Growth as increase of the market value of goods and services.

Basically every company should grow in order to make more money, so increasing the market value of goods and paying taxes, the services of the Country where they operate.

The concept of strong economical growth at Country level is fundamental in emerging economies where it’s urgent to reduce poverty and build basic infrastructures such as roads and access to basic services like drinkable water, electricity and gas.

Conversely in developed Countries the continuous grow became a boomerang i.e. decreasing the quality of life of people for low/no returns.

That’s where we lost happiness to get almost nothing in change.

In a nutshell: being stuck three hours in traffic to work and contribute to economic growth in a third world emerging country might be worth if I am going to use such hard earned money to feed my kids, have clean water in the house or a roof under my head.

But (and this is a HUGE but) if I decided to be stuck in traffic in L.A. or San Jose mainly to pay the mortgage of my 4000 square feet (where I am not very often anyhow because I am always at work to pay the mortgage!) or the loan on my new cars or the latest cell phone, camera, luxury gadget etc. is very different.

We need to spend the money (as result of the growth) in something that improve our lives as total balance.

If, in a scale 0-10 (with 10 meaning full satisfaction) working is reducing my lifestyle let’s say by 5 points but what I can buy with the earned money is increasing +8 (to feed my kids or having clean water in the house etc) the balance is positive. (-5 +8)

Conversely if a bigger mansion or the new “toys” give me back 2 o 3 point of quality life there is something wrong.

Let’s take the car for example

I had several discussions with friends making 1300-1500 USD (or Euros) per month on this subject.

I show them that, using a conservative calculation, an economic car (purchase price, repairs, insurance, tax, gas excluded) costs at least 1000-1500USD or Euros PER YEAR.

This means that they work one full month ONLY to have a metal box with the wheels on the road that they use it….90% of the time to commute to a job!

So… I need the car to go to work and I need to work to have the car…can you see something strange here?

You might think, there is no solution, I need to work and I need the car… are you really sure?

Did you consider all the options?

Like using public transportations? Moving your house closer to your job or …biking/using a cheap scooter to go to work?

Or, if really having the car is a must, what about to buy a cheap, low consumption and used one and keep it for ten or more years ?

We are so blinded by the mantra find a job, spend your money, pay your bills and die that we don’t even realize what we are doing.

Every penny spent needs some work to do in order to earn it and this work needs your time that you will not be able to spend with people or doing things you love.

Think about it, every time you spend money think in term of time needed to earn it, time staying with people you might hate, maybe your boss, your coworkers, your customers doing a dull and stressing job.

Our mindset should shift from “We work because everyone does it” to “We work in order to be happy”

Happy because our job is IMPROVING our life either like in the case of the person living in the developing countries or if working is satisfactory or if the money are good enough to aim to a quick financial independence.

Ignorance

People live paycheck by paycheck because they ignore there is another way of living.

Clear, simple and dramatic.

They make 10 and they think they are entitled to spend 10 (or 12 or more especially in the USA where paradoxically everyone should be very rich compare to other places in the world ).

The solution? Financial Independence

The only way out that is saving to reach Financial independence (FI) like we already discussed.

The formula is very simple:

If

I spend each month $XXXX

I am able to generate revenues from passive investments (rental income, side job, dividends, blogs, etc) $YYYY

If $YYYY is ALWAYS equal or greater than $XXXX I am financially independent => I don’t need to work a single day in life anymore.

Everything boils down to three numbers:

1) How much I spend each year ($XXXX)

2) The net worth I have that generate the passive income ($YYYY)

3) The interest rate of the net worth that generates the passive income (Z%)

As said the FI is reached when

Expenses <= (Equal or less than) Passive income

Being

Passive income=Net Worth * Average interest generated by the net worth

We have:

Expenses <= (Equal or less than) Net Worth * Average interest generated by the net worth

Let’s make a practical example

Yearly Expenses=$24,000

Net Worth = $1,000,000

In this scenario we need a net interest of 2.4% ($24,000/$1,000,000 * 100) to cover the Yearly expenses

If our net worth is $2,000,000 we would need only a net interest of 1.2%.

Intuitively if we reduce our Yearly Expense to $20,000, we need a net interest of 2% ($24,000/$1,000,000 * 100) to cover the Yearly expenses

If our net worth is $2,000,000 we would need only a net interest of 1%.

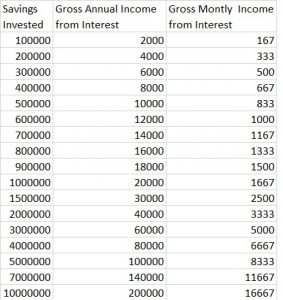

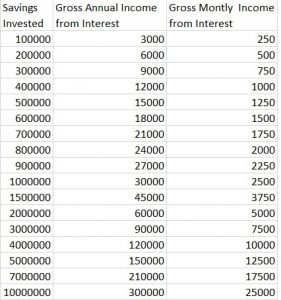

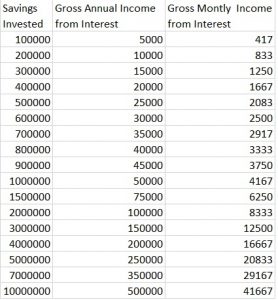

Let’s examine some scenario

To get $24,000 per year with 2% return we would need $1,200,000…with $5,000,000 saved we will net $100,000per year before tax…with $600,000 we can afford a $1000/mo lifestyle.

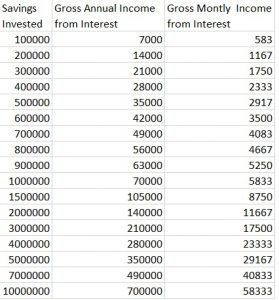

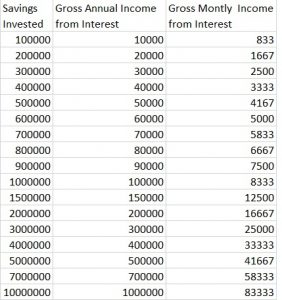

Let’s see what happen when we bump our saving rate to 3% – 5% – 7% – 10%.

Thus Making, Spending and Investment Return is all what you need to know

1) Making

Making is the active action of making money i.e. you are doing some actions to generate that cash and if you stop doing it that cash flow disappear almost immediately.

Typically the sources are:

1) Your primary job (9-5pm or entrepreneur)

2) Side job (selling stuff, blogging with revenues, uber driving etc.)

3) Passive Income from Investments (dividends, royalties, real estate rents, peer2peer lending etc.)

Usually you know what’s the average income you can get from these activities, let’s forget for a while the possibility of inventing a great product that will skyrocket your income and let’s focus on your average income.

You know what you are making but maybe you are under evaluating how much you can increase your income.

Typically (unless you are already in a high expense area with well above average salary) you can double your income simply changing job description and/or Country.

Yes double.

I know several people (me included) who doubled or tripled their salaries simply changing function or more commonly workplace.

But guess what…?

Not so many…why?

Because People are resistant to change

They prefer 40 years of paycheck to paycheck agony vs 10-15 years maybe far from home or in an unconformable job but with a solid income and reaching a financial independence.

Comfort and agony….if we add no tight expense control to equation you are doomed to 40 years of mediocre job and life.

You might be happy, sure, but honestly today I found that 90-95% of 9-5 people are complaining about their job, peers, boss etc. and their hobbies, vacation or family time is never enough to compensate the 80% of the time they spend for job related activities.

Being happy while you spend almost all of your low income is not the pathway to happiness…we know that…

So….what should we do?

Changing radically our job or location?

Yes (in case you missed it this was a big yes…)

Listen, if you are lucky maybe you don’t have to change location but it will be almost impossible to double your salary remaining in the same industry and region (unless you are enslaved in the actual one).

One alternative is to change industry and move to a better paid one. You might need to go back to school and get more skilled for that.

Or get skilled on making money on the internet flipping stuff or blogging or become an influencer in something

Whatever it is you need to take BOLD actions.

2) Spending

This is the easiest part, believe me.

I am already hearing you “come on man…I am already cutting corner everywhere…where can I find that extra $10!”

Are you sure?

Do this exercise for me.

Track every expense for a month (to the dollar, euro, rupia, yen, rmb…whatever else) and analyse it.

Are you still sure you cannot reduce eating out so often? Or using that car? or cancel the expensive subscription you never use? Or reducing wasting food?

Or not buying the thousands of expensive and useless gadget? Or in vacations?

Yes you can and you must to reach FI.

Reducing expenses is much important than revenues because it has a double effect: for every dollar saved you reduce the money you need to reach the financial independence AND you can invest that dollar that will produce passive income

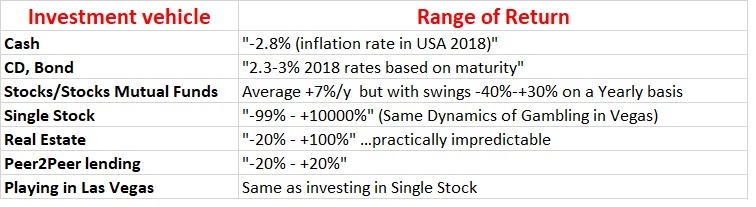

3) Investment Return

That’s the tricky one, especially if you are not skilled in investing.

It’s intuitive the fact that higher is your Return on your investment (or Yield) higher is your monthly check from the investment…but what is high and what is low?

The easy part…Higher the risk higher the return

The difficult…find a sweet spot between risk and returns

There are 3 or 4 way of investing after tax money…here they are

Confusing…?

I bet it is but it might be much more simple than you think…

What’s next

In next post we will go through these difference way of investing…for now just keep in mind that the solution is simple: saving enough money so that the passive income generated by your investment will cover all your expenses.

This is call Financial Independence, i.e. you are independent (free) from working to have your finances covered

To most of the people Financial Independence is like a dream….something not real…something only for very rich people.

Whenever I talked about it most of the people dismiss me with a gentle “whatever“, like I told them they only need to win the first price of the lottery tomorrow to make it.

These are the same people who live a miserable life of paycheck to paycheck slavery…I wonder if there is a connection…

But if reach the end of this post you will not end up like with those people.. I promise you…just wait for next post…