Saving Saving Saving

And if we are all wrong?

Like who was saying that the earth was flat?

Let’s see the life of our best friend Joe…

Enter Joe

- Fresh Graduated with BSEE

- 25 years old in 2025

- Engineer employed in a software company

- Living in Colorado

- Single

- First paycheck including bonus before tax $75,000

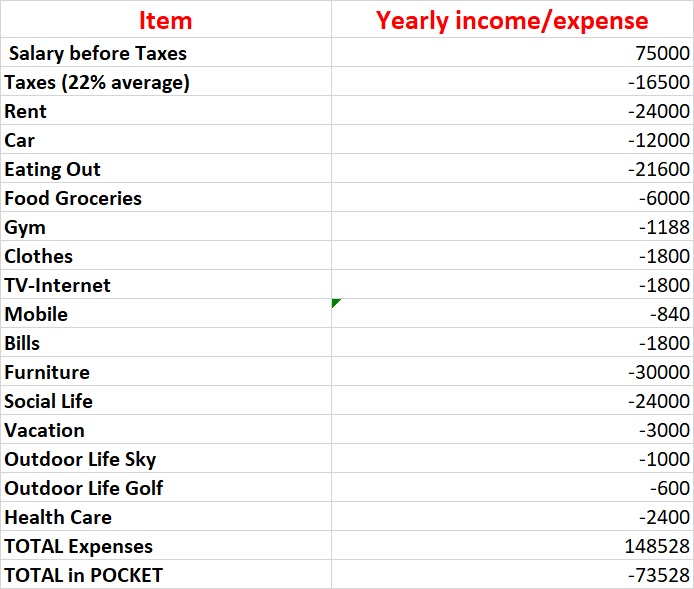

January 01 2025

Joe was lucky…his parents paid for his college in a middle end university and for his used car (now ten years old).

John is very happy with his salary…a lot of money…

HR mentioned him about something called 401K and the importance of contribute to it…the company match..and the fact he is supposed not to touch it before 60 years….

Naaaahh this 401K is really complicated and looks useless and risky…then touching the money only when I will be 60 years old and very likely dead…? No Way!

So Joe starts his single life…

House $2,000/mo

Mhhh…the new apartments downtown Denver look very nice…$2,000 maybe a little expensive but…hey they are walking distance from all the cool bar an d restaurants of the area and you know I don’t want to move to a single family in the suburbs..I will do when I will be 40 years old and with two kids!

Bills (Electricity, Gas, Water, Misc) $150/mo

Joe is seldom at home, but when he’s there he wants to forget how cold is Colorado…!!! Luckily apart of electric bills he doesn’t spend much more on other utilities.

Car $1,000/mo

The 2015 Nissan look very old and crappy. I cannot leave in this suburb with this car and go out for a date with it…

Since now Joe is working credit is easy…so…what’s best than buying a new car especially now that there is a fantastic offer in the BWM dealer?

Put some gas, parking and Insurance…roughly $1,000/mo…no bad right?

Eating out $1,800/mo

Joe never cooked at home and his parents never thought him.

Anyhow there are so many restaurants downstairs for a quick dinner, Starbucks for breakfast and a great selection of salad bars around the office for a healthy lunch!

12$ Breakfast 18$ Lunch 30$ Dinner…not so bad!

Food Groceries $500/mo

Joe has no time and he doesn’t cook so he doesn’t need much food.

The upscale groceries store is just walking distance from his apartment

and hey..so many organic products!!!

500$/mo in so healthy products (too bad so many are thrown away because Joe is too busy and he forgets the expiration date)

Gym $99/mo

Mhhhh all that food and 8 hours sitting in front of the computer is manifesting big time on Joe belly…time to Gym..!

There is a cool Gym downtown…the price…a steal…all you can go open 24h and with swimming pool only $99/mo…!

TV – Internet $150/mo

When Joe come back he needs some relax..so what better than a 80″ 4K TV (5000K$) with a nice Internet + TV Cable + Netflix package for only $150/mo?

Mobile $70/mo

Joe has many friends right? So the unlimited data package at $70/mo is a must for his video call and social network…hey there are more expensive one…you know?

Furniture $30,000 (one time)

Having lived with his parents Joe doesn’t own practically anything…

and he has a 1200 square feet to fill now..!

Surely he doesn’t want cheap IKEA furniture in his posh apartment…besides he just discovered that in Boulder downtown there is a cool and trendy furniture store that import directly from Italy.

Wow…he has practically to buy everything…total expense $30,000…but it’s one in a lifetime!

Social Live $2,000/mo

Denver it’s so cool….! He cannot resist his clubbing, bar hopping and restaurant before Thursday (sometimes even on Wednesday)…

$500/week…well spent!

Clothes $150/mo

I really cannot go to work and in the club with the Ninja T-shirt I was using in the college…I need to dress like a young professional man now…Time to invest in my look!

Vacation $250/mo

Being a software engineer at XWZ tech Inc is very stressing!

Joe really needs to take a break from the cold of Colorado during his weeks off.. what’s better than hopping on a plane to Mexico or Hawaii…? $3000 really well spent!

Outdoor life Sky $1000 (one time)

Joe live in Colorado…he must learn how to sky…!

And so many people in the office go….

Here he’s with a brand new unlimited seasonal pass for only $999 (it was $1200…what a deal!)

Outdoor life Golf $50/mo

Well…with so many sunny days, great golf courses and many Managers and Directors playing in the company Joe must play golf during summer…poor Joe…with all the hours spent in the cubicle he really needs some fresh air

Health Care/Insurance $200/mo

Joe’s workplace offers a great Health Care package with only $150/mo from Joe pockets. Add a couple of visits for cold and small stuff (Joe is so young!) and the total cost is very limited.

The first year is gone…what a year!

Let’s crunch some numbers

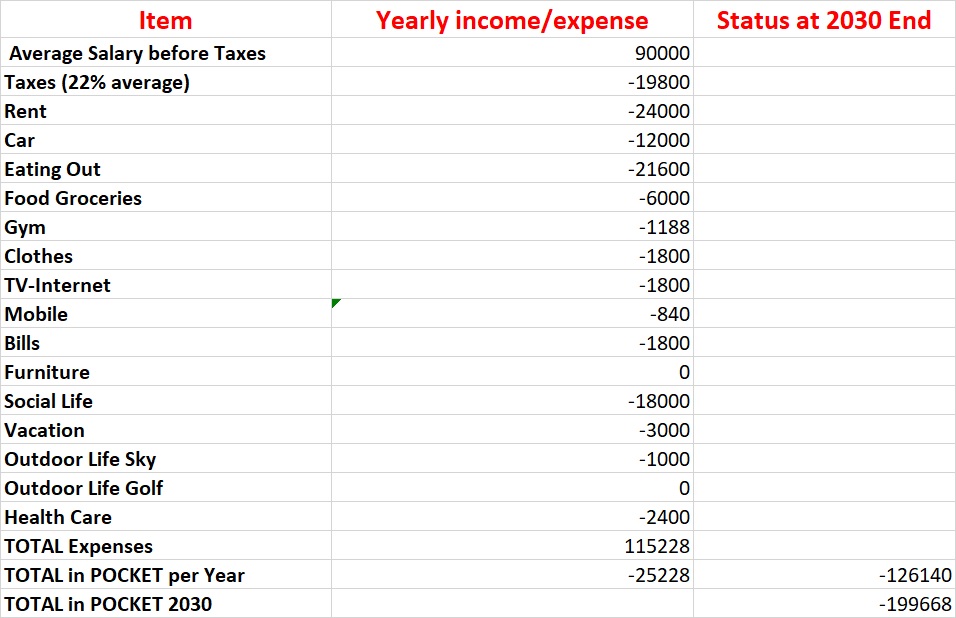

2025-2030

Joe had great 5 years as single guy in Denver.

The job was doing great…now he finally reached the six-figure milestone!

He also found a nice girlfriend and got engaged…thus the sweet single life is getting to an end soon.

Expenses wise he’s still doing the same life…just cutting off golf (too boring) and social life since he found a stable partner.

Let’s see where he is …

The good news is that Joe parents gave Joe (only child) their second home and he sold it for $250K thus so far no need of credit card debts.

Life is great for Joe!

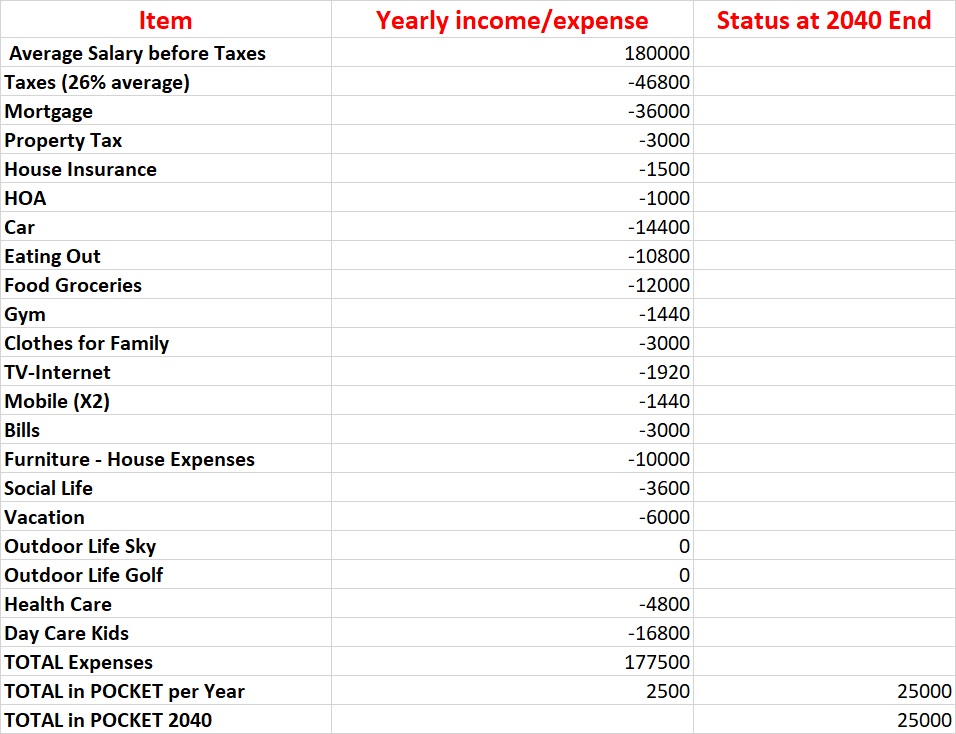

2030-2040

Joe gets married and two kids enlighten his family life!

Joe also get promoted as Director of Engineering in a new high-tech company close to Boulder and his salary and benefits dramatically increased.

Also the health care expenses increased with two kids in the family.

Kids also added day care expenses to the balance even though Joe’s wife is not working.

And of course a bigger family requires…a bigger house and cars ! (and vacation budget).

Luckily the social life expenses almost dropped to zero….

Here we are…

Here it is Joe at 40 years old with some money in his bank….almost $25K…!

Joe feels almost rich with that amount available…now he can afford that vacation in Europe with the new 100″ TV or why not a boat or a new car.

$25K are a lot of money…isn’t ? Especially when almost of his peers are into deep debts…!

Of course Joe doesn’t want to hear about investing…he knows people talk a lot about Dow Jones, S&P, mutual funds…too complicated and surely a scam.

In any case Joe already made a great investment with the house…is not real estate the best investment around?

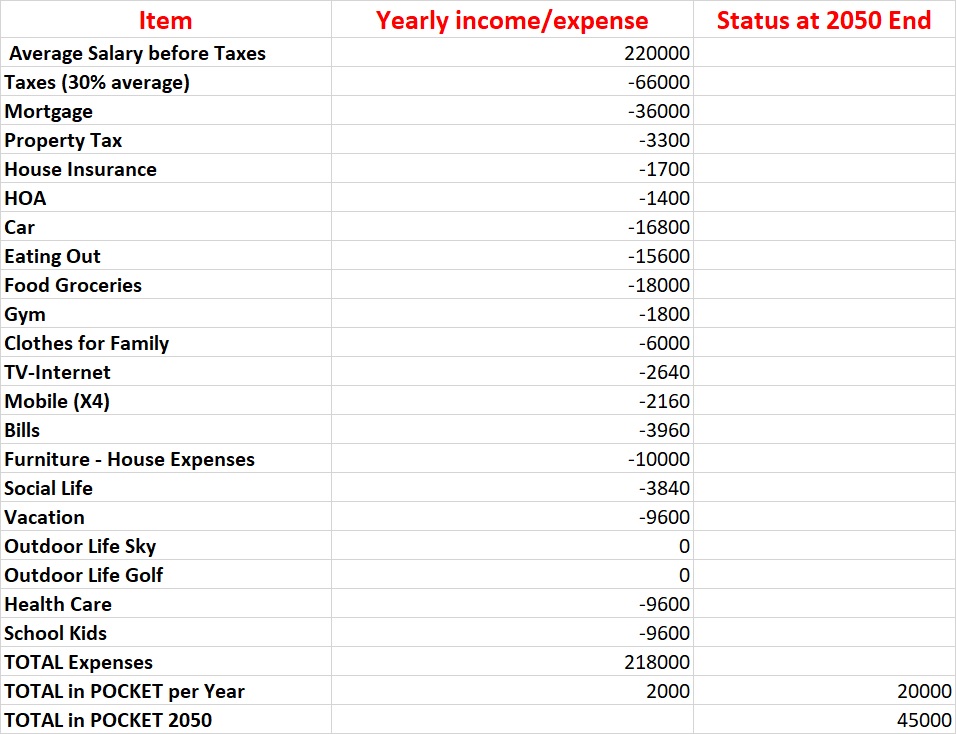

2040-2050

Kids are growing.. both are in High School now.

Joe got another promotion as Vice President of Engineer in a start up….those are the peak years of making money.

He’s happy because when he turns 50 years old he reaches 45K$ in saving (all of them in his checking account since he’s still not trusting the traps of investing!)

Also all expenses increased: Food (two big boys are always hungry!), Health care, Mortgage, Property Tax, Car Payments, Bills, Clothes etc but likely Joe is making great money…so no problems!

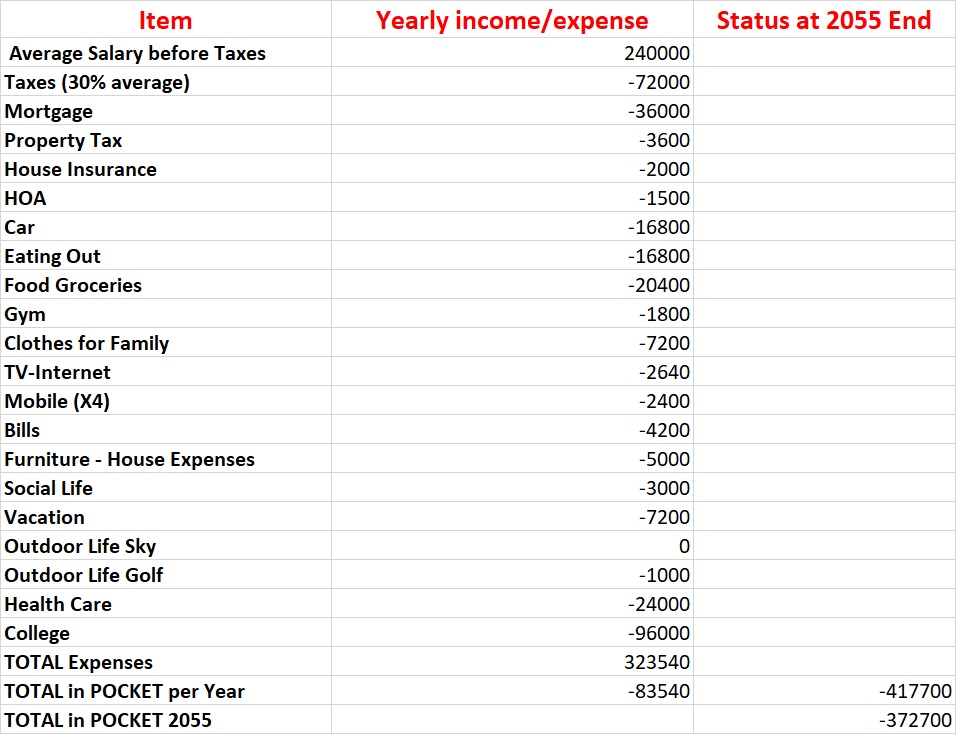

2050-2055

College years for the kids…both in an affordable one so the expenses are limited to $4K/mo per kid…all included (no bad right?).

Health care expenses are going up…Joe and his wife are both in their 50 and co-payments and dentists expenses increased and the kids are still on their insurances plan.

Joe started again with golf thinking about retirement…

Economically the situation started deteriorating…not only Joe spent all the saving but now he has almost $400K debts at 7% average in college loans and on a couple of credit card.

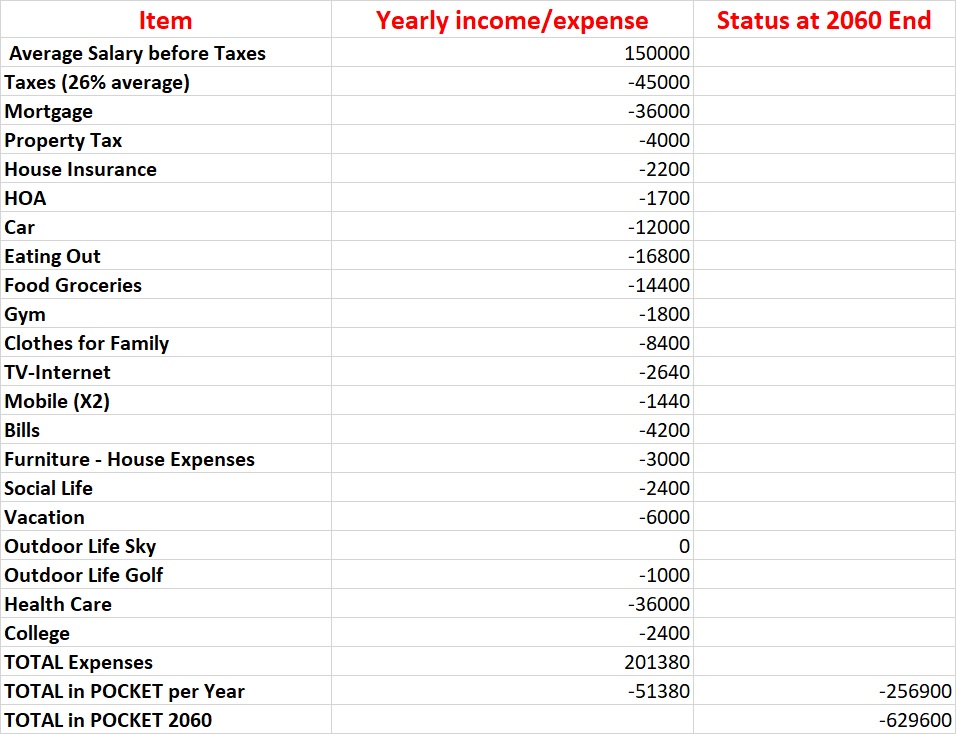

2055-2060

Joe and wife don’t think downsizing from a big house (now empty since the kids left) and luxurious European care is a wise move.

After all they are affluent middle class right?

Joe was caught in a sudden layoff due to economical crisis and, as usual, the highest paid are the first to go.

He stay almost one year out of workforce and he found a job as Manager R&D with a substantial pay cut.

Luckily the kids are practically out of college and all almost all the expenses of Health care are for him and his wife.

Unfortunately their expensive lifestyle is costing more than Joe salary…roughly $50K are going into credit card debts per year to compensate the expenses.

It will go better now with kids out of college!

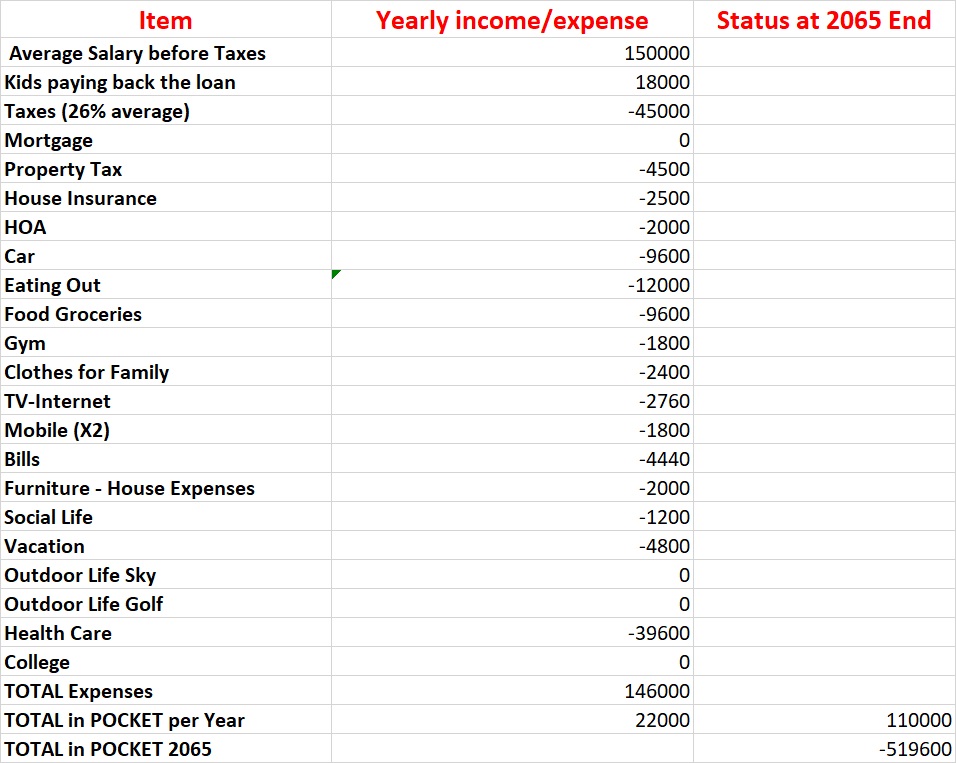

2060-2065

Joe job is stable and kids finally are paying some of the college loan back.

Great news…no more mortgage and Joe finally decided to buy a slightly less expensive car.

All the other expenses are going down as well apart the health care since they both went under a couple of surgeries and therapies.

They were able to save more than $100K in five years…not enough to finish to pay the debts…

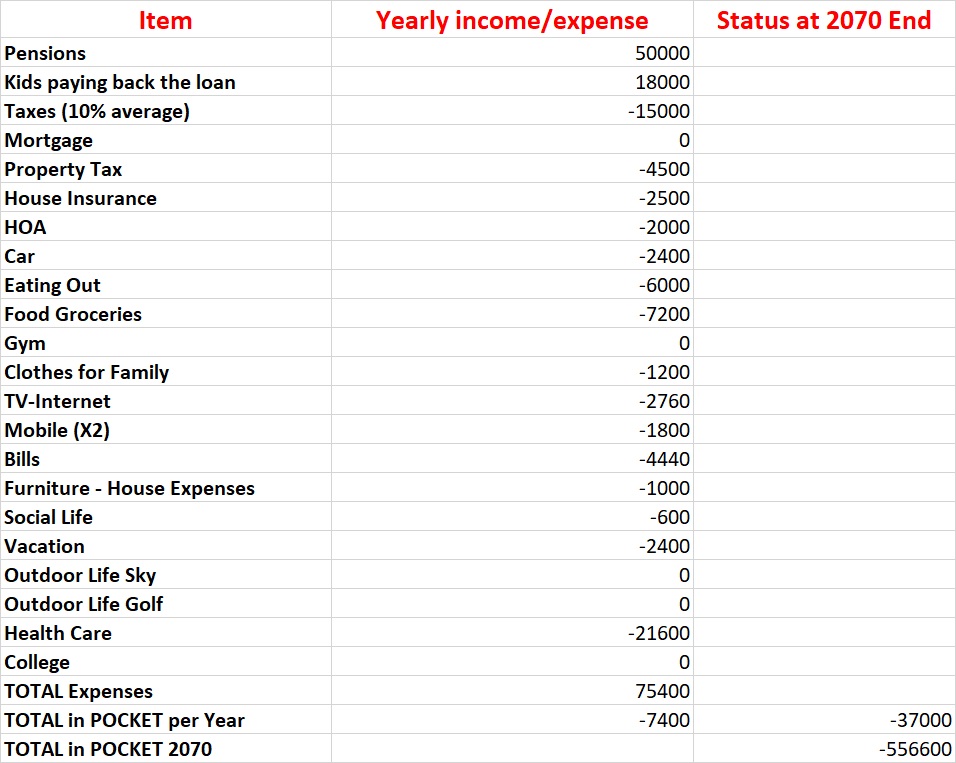

2065-2070

Joe retired.

Between Social Security and Companies pensions is bringing home $50K before taxes.

As we know Joe never believed in investing or 401K so the $50K before taxes is all they have.

Kids kept giving the money back for the students loans but in 2070 they repaid everything and now they have their own family to take care of.

Joe and wife are roughly more than half million dollars in debts.

2070… and the future

So what now…?

Joe and his wife now are forced to downsize the house and giving up the expensive cars.

Doing so they are able to reduce their debt to $300K in 2072.

Too big anyhow the debt (at 12.5% interest on 5 different credit cards and one home equity) to be repaid.

Joe and wife will likely die poor in some hospice giving as gift the debts to the kids.

This is no fantasy

Every year thousands of people end up like Joe and his wife; despite making a great salary while young and having his parents paying his college.

Every years people cannot realize they are spending more than what they make and that they need to save money for the future.

This is no fantasy…this is the sad typical middle class life.

Don’t be one of them.